Got an email or text message about a tax refund? It’s a scam.

IRS impersonators are at it again. This time, the scammers are sending messages about your “tax refund” or “tax refund e-statement.” It might look legit, but it’s an email or text fake, trying to trick you into clicking on links so they can steal from you. How? They tell you to click a link — supposedly to check on your “tax refund e-statement” or “fill out a form to get your refund.” But it’s a scam and if you click that link, the scammer might steal your identity or put malware on your phone or computer.

If someone contacts you unexpectedly about a tax refund, the most important thing to know is that the real IRS won’t contact you by email, text message, or social media to get your personal or financial information. Only scammers will.

Get ahead of these scams by learning about their favorite (and most successful) techniques. Here’s how to protect yourself this year:

Phone Calls

Although each call is slightly different, they all begin the same way: an unexpected caller who claims to represent the IRS or another government agency. The agency’s name may even show up on caller ID. The caller may say you owe taxes, and if you don’t pay them immediately, you risk arrest. In a tricky twist on this premise, the caller may tell you your Social Security Number has been or will be suspended, and you need to confirm your number to reactivate it. In some cases, you might get a prerecorded message that demands a call-back.

What You Should Know

- The Social Security Administration (SSA) will never threaten your benefits, and the Internal Revenue Service (IRS) will never threaten to bring in law enforcement.

- Never provide any information about yourself over the phone, even if the caller knows the last four digits of your Social Security Number. Hang up.

- If you owe taxes, the IRS will mail a bill and allow you to request a payment plan. True IRS agents won’t ask for credit or debit card information or demand that you pay with gift cards or a wire transfer. And, they’ll always tell you to pay the U.S. Treasury—not someone else.

What You Can Do

Not sure if you owe taxes? Find out on the IRS website and see what payment options are available to you. You can also call both the IRS and SSA to verify if what you’re told is true.

- Internal Revenue Service: 1-800-829-1040

- Social Security Administration: 1-800-772-1213

Emails

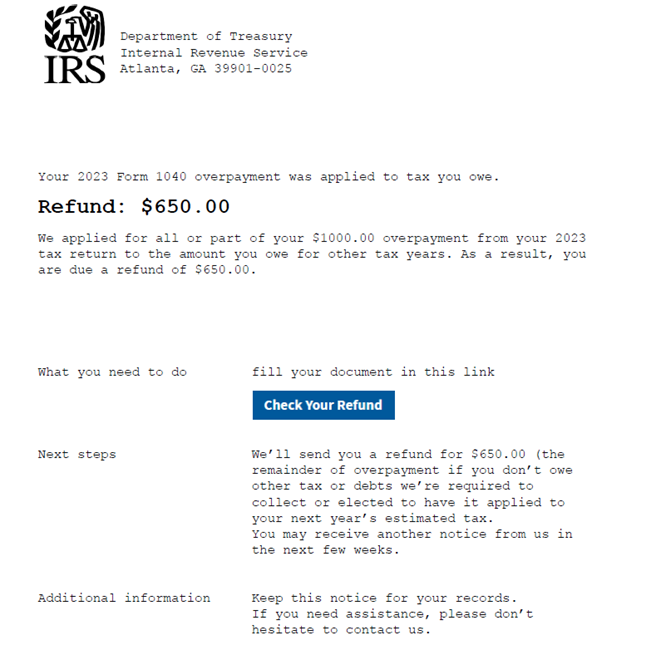

Another common scam takes the form of an official-looking email that supposedly comes from the IRS. Often, these “phishing” emails invite you to click a link for information about your tax return or refund, and they may even include a temporary password. The link will appear to lead to IRS.gov, but will actually send you to a fake website that captures your personal information.

Here's an example of what an email could look like:

What You Should Know

The IRS will never contact you by email, text message or social media. The agency only sends correspondence through the United States Postal Service (USPS).

- Fake IRS emails usually have eye-catching subject lines like “IRS Important Notice” or “IRS Taxpayer Notice” because they’re very effective at getting people to open them.

- Scammers may spoof the sender’s email address to make it look like it came from the IRS and, once opened, it may even have the official IRS logo.

- Clicking the link will download malware that infects your computer. From there, it’s easy for the scammer to gain access to your financial information.

What You Can Do

Don’t click! Report suspicious emails to phishing@irs.gov.

Tax Preparation

The promise of a big tax refund is tempting, and tax prep scammers know it. Fraudulent tax preparers will offer to do your taxes for a percentage of your expected refund. Then, they’ll add information to your tax return to pump up that refund—fake or exaggerated deductions or credits, and they may even falsify your income. By the time the IRS catches the false information, the scammer is long gone, but you’ll be left to pay the consequences: more taxes, interest, penalties and possible criminal charges.

What You Should Know

- The IRS requires legitimate tax preparers to sign your return and include their Preparer Tax Identification Number. Unethical preparers won’t include this.

- Scammers often require payment in cash and don’t provide a receipt. Others may even divert your tax refund right to their bank accounts!

What You Can Do

You can find a qualified tax professional in your area by visiting the IRS Directory of Federal Tax Return Preparers with Credentials and Select Qualifications. Review your tax return carefully to make sure it’s accurate. If you’re due a refund, make sure your bank’s routing number and your bank account number are correct on the final return.

Identity Theft

If scammers manage to snag your Social Security Number and other key identifying information, they can file a tax return in your name and claim a refund that belongs to you. You might not realize this has happened until you try to file a return yourself, only to have it automatically rejected—the IRS only allows individuals to file one refund (unless amended).

What You Should Know

- Check that the earnings reported on your Social Security statement match your actual earnings.

- You’re more likely to prevent scammers from filing a return before you if you file your return early.

What You Can Do

If the IRS rejects your return or you’ve received a notice from them, call the Taxpayer Protection Program at 1-800-908-4490 for help. They’ll ask you to prove your identity, so be ready with documents like your birth certificate, Social Security card and at least one previous tax return.

If you determine that you’ve become a victim of identity theft, the IRS suggests you:

- Contact major credit bureaus and your financial institutions.

- Close any accounts opened without your permission.

- Consider a credit freeze.

- File a complaint with the Federal Trade Commission (FTC).

Outsmart Scammers This Tax Season

Unfortunately, tax season is the most active time of year for scammers. Even if they’re not successful, you’re likely to come face-to-face with at least one of these scams this year. Keep these tips in mind to safeguard yourself and file your taxes with peace of mind.